After longer break I decided to post short update about my investments.

Investments in Euro (fiat currencies)

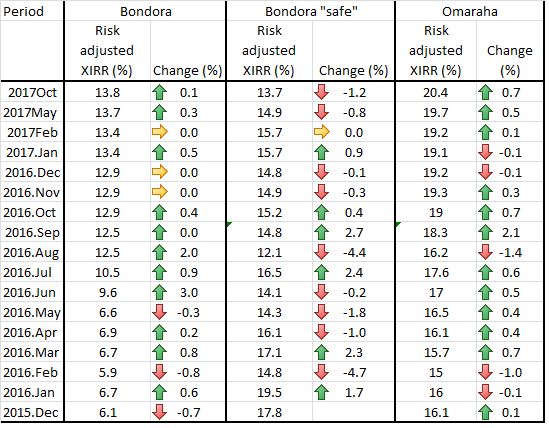

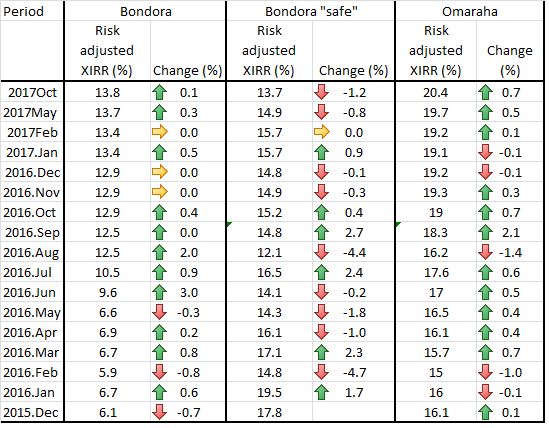

Bondora. My return at Bondora stay quite stable. That is below my planned 15% return, but it is quite stable now. I am not lowering portfolio, but possible I will add more into Bondora if I will have some free euros. There are 3 reasons First, Bondora claim they become profitable. Second, I know that in case of urgent need I will be able to withdraw from Bondora 5-10% of my portfolio withing 2-3 days without selling loans in minus. Third, my work at Bondora is quite automated now and profitability quite stable.

I do not like to advertise Bondora, but if you like to be mainly passive investor and happy with 8-12% return and if you you like to try Bondora and support my blog, please join Bondora using this link: https://www.bondora.com/ref/Andrej

Omaraha. All is very ok. Still – no work needed. Again my return went a bit up. Regulator have introduced maximum interest rate in Estonia. If you invest on Omaraha, you need to check your investment terms and make maximum interest as 35%

TWINO. My return went down to 11,7%. I do not withdraw money, but I will definitely not add any new when only such return is available with guaranteed loans.

Investments in BTC and crypto currencies

I do not place any table there. BTCJAM and Loanbase are in closing phase, my return on BTCPOP is below zero. Overall BTCPOP is fine, but I have invested too much using feelings, not using brains.

If you like to try BTCPOP and support my blog, please join platform using this link or pressing on their banner right to this text. Thank you in advance! Sure if you join using my link, I will be happy to help you with funding and advise

Trading

Again, do not like to post any tables, but altcoin trading is positive. I was quite passive during the summer.

Consolidated return from crypto projects

Consolidated return in BTC is still negative (but is better than in May), risk weighted return in Euro is positive and XIRR is over 20% before taxes.

Wish you all nice investments, please, stay careful and have a sucessfull end of 2017!