I would like to explain decision to lower my portfolio at Bondora.

Bondora was my first p2p lending platform. I did first investment in February 2013. It was something very new and interesting. Today I know, I was quite naive and did many mistakes, but I was happy with proposed return. Later, around the end of 2014, I read couple of discussions, did my first calculation of risk adjusted return (XIRR) and did my first look on rate of default. I was quite shocked, when I understood that I have lost almost one and half year and my risk adjusted investments give me almost zero return.

I have started to build small datamodel to organize data about loans & secondary market and data from my personal dataset. That gives me a possibility to monitor constantly historical data, result of investments and do some automation. At the same time, around the end of 2014, I got a nice occasion to meet another investor at Bondora, an excellent data analyst, one of most professional statisticians I have seen during my short but several year banking experience. Together we spent much over 5000 hours with data automation, data mining and analyse. Very often I have heard “no data”, “too early”, “too small dataset”, but later my colleague have found several interesting scenarios to invest. And recently he said “enough”, too.

Why I am telling this? Just to show you that it is so painful and sad for me is to say “I lower my portfolio”.

Let’s look on several issues.

- I am not happy with time spent and achieved result.

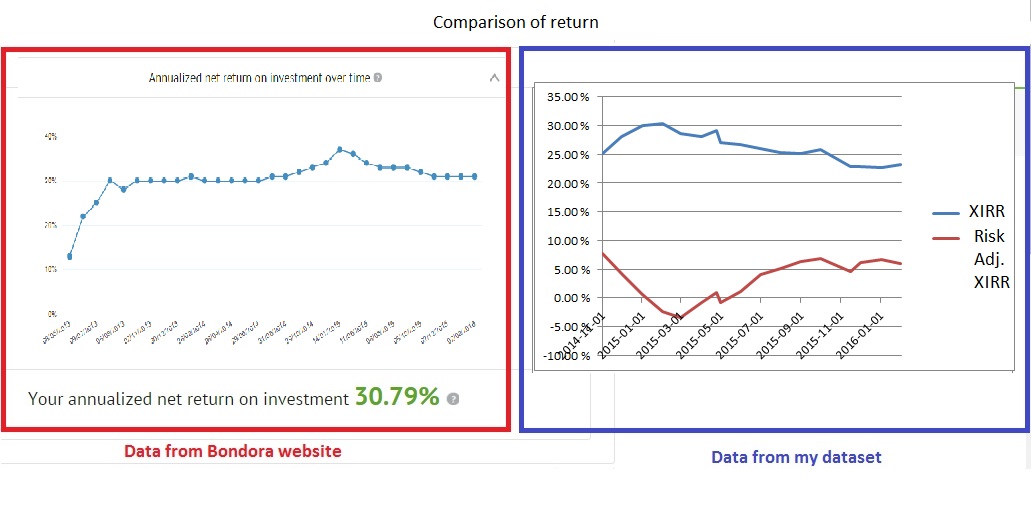

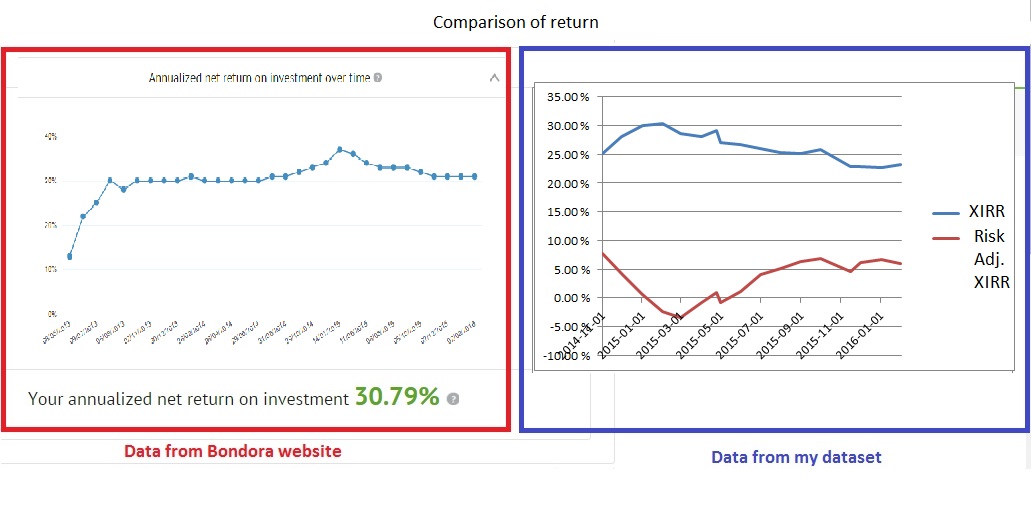

Long time Bondora show my return bigger than 30%. But I have never got so nice result. When I count with Excel, my XIRR is around 23%. More, I count an “exit scenario” to simulate possible exit from Bondora in 2-3 weeks. For that I calculate a sell of my “green” portfolio at 100%, a sell of overdue loans with 50% discount and a sell of my defaulted loans with 80% discount. In such situation I am getting my XIRR just around 6%.

- It is close to impossible to implement any own investments strategy with Bondora.

I had several supporting scripts, but it cost too much to support them working, as Bondora is changing layouts quite often (not necessary in better way and not necessary without bugs). I invested into automatic dataloading, but Bondora is changing dataset format without announcements and documentation. And several times they did changes in meaning of data, that breaks data consistency.

- I am unclear of rules what Bondora will use each next week.

Today it is still possible to invest manually or via API. Tomorrow Bondora may change priorities and manual or API investments will be moved out to the end of queue by institutional investors or Bondora’s Portfolio Manager.

To invest is only part of work. It is almost more important what you do after your invested. But it is unclear how Secondary market will work and how it will affect investors. I worry that exit from Bondora will be more difficult.

- I am not a programmer to develop own API and I do not like to share my connection details, my investments strategy, my results to any third party

- I cannot accept Bondora’s way of communication.

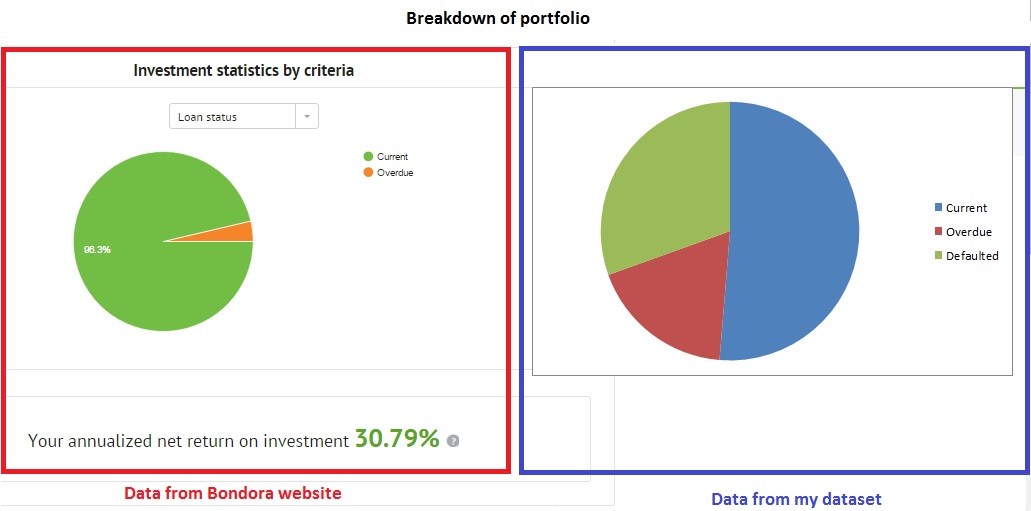

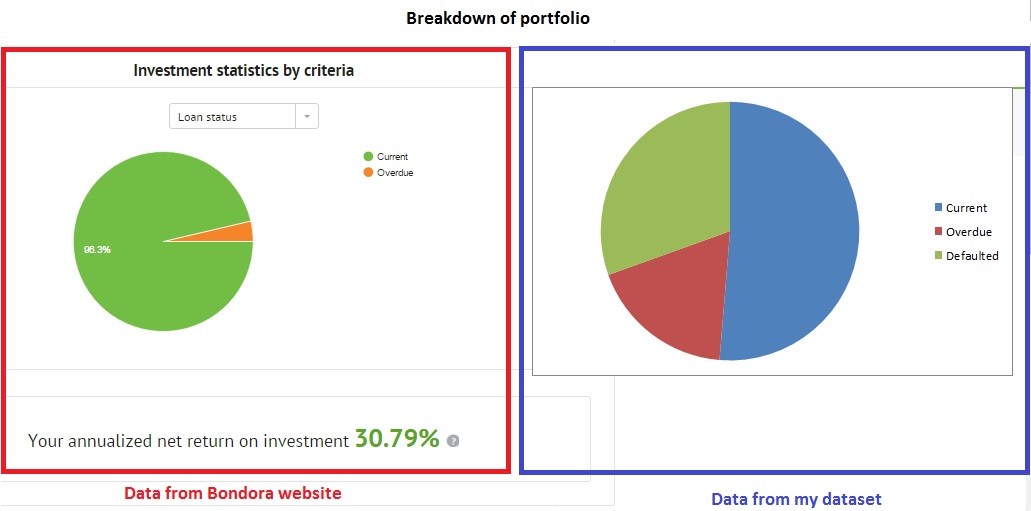

I think Bondora misleading investors, when “hides” real amount of late and defaulted loans. I think one day it may cost Bondora a lot. It may even stop their existence.

In my opinion they use more than optimistic way to calculate status of portfolio. It is strange for me, but today when I use different p2p lending platforms, quite often I am looking why platform is showing me lower return versus I have calculated in conservative way with excel. In case of Bondora it is different.

There are cases of fraud, when borrower asking for loan without intention to pay. Hi/She gets loan and disappears. What Bondora do with that? They simply count that this borrower like he will pay without problems. So, if he not paid 2 month before going to default, they skip that 2 month, but rest of future payments are counted as “green”, even it will cost a lot of time to collect money.

Since 2013 over 2900 of borrowers failed on first payment. Only about 180 of them have repaid borrowed principal. Only about 1200 of them have paid more than 10Eur of interest.

Bondora counts in most of cases recovery of “Principal amount” instead of recovery of Principal+Interest+Late fee. Recovery of principal amount simply means that money were wasted, lowered by inflation and at the end an investor got back part of money after 2-3 yeas. More, Late fee is not used anymore. Simply means that late/defaulted money does not give you any interest. More, cost of collectors are included and not visible. You may buy item on Secondary market hoping to get good profit. But who knows, may be most of this profit will go to collector.

- Bondora never say “sorry”. Even they were telling that Slovakia and Spain are same good as Estonians. Even they failed with recovery in that countries. Even they did number of other bugs.

- Bondora closed forum and left only blog – an official moderated propaganda channel. I was not big favorite of “all is bad” discussions, but forum had a lot of other good discussions. Forum was nice (and in fact the only one) channel to find answer to question and discuss i.e. implementation of API, investment techniques, announce big discount deals, etc. Each topic had hundreds and thousands of views. It was possible to use it to get new ideas, get information about bugs etc. Instead of properly supporting community Bondora closed it. Ok, let’s Bondora feel fine, with comments-free one way posts in their blog. Sad, that company do not understand difference between forum and blog.

- I do not like to fight anymore with different small bugs and I don’t like to spend more time to cross checking data after each change (“innovation”) at Bondora. I have noticed, that instead of listening users, Bondora leaves buggy or “half made” system. Then investors do some scrypts or plugins, getting missing functionality fixed. And then after year of several month, Bondora may come with requested functionality (not necessary clean of bugs). I reported number of bugs to their support. I do not like that in my opinion most of support is far from understanding how investments works and what is in system. I got cases when buggy functionality was simply removed instead of fixed.

- I do not trust Bondora’s development team. Too many bugs, too many not tested releases. Too much of testing on live system. To many next bugs when fixing old one. I do not see good “owner” of system.

- I worry that Bondora not growing when competitors are able to grow. Venture capital do not like when startup is not growing (at time when market is rising) and startup is still unprofitable. Mintos and Twino started years after Bondora and are bigger than Bondora today (source)

- Competition. There is number of platforms that offer same or almost same risk adjusted return with less time to invest.

Saying all this, I still do not close my doors to Bondora. May be they will change. May be they will stabilize development/communication, may be they will provide some special offers. I still have small “safe” portfolio with a bit better return. I will look if it is possible to save such return. If you stay with Bondora, I highly recommend to use Oktaeder’s plugin (a “sponsored” version – press there) and I really recommend you to monitor result of your portfolio. Some points how to do it, you can find there.

Thank you for reading and thank you in advance for any comments, questions and notes! Please subscribe in order to get my new posts if you feel that they can help you 🙂