I had intention to write a fast and easy post about the result of my investments at BTCJAM. I count result of my investments there since day of first deposit March 14, 2015. Post was planned to come in 20-30 minutes. But… I got surprise!

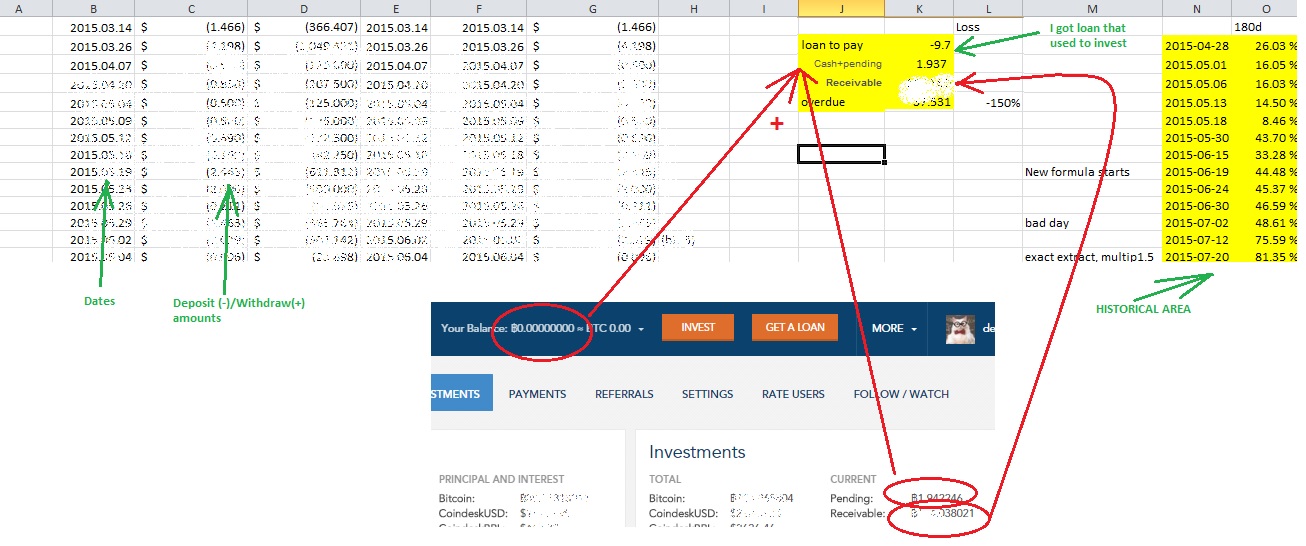

To track result at BTCJAM I use Excel and XIRR function (If you like to get idea how I do that in Excel, please look my post Tracking result of investments)

In calculations I use risk adjusted value of portfolio:

Value of portfolio = [Cash+Pending] +Receivables – Overdue x 150% x 90%

where last 90% is result of my assumption that 10% of Overdue will recover or will be sold.

To calculate Value of Portfolio I add the following numbers

To calculate amount of Overdue, I download all investments and filter all Late+Defaulted. I have my own small javascript that help, but I found that BTCInvestorGuide plugin may be also useful for that. Then I multiply my Overdue number by 150%.

If you do not like idea to download all investments, you may take  amount of Late+Defaulted from Payments page and multiply by 2.5 (instead of 150%).

amount of Late+Defaulted from Payments page and multiply by 2.5 (instead of 150%).

For monitoring I calculate value of portfolio after 270 days (Today+270). This corelates with average duration of my portfolio that is growing, but still not exceeding 265 days.

In invest in b oth Currency-tied and BTC loans. BTCJAM is telling me that my return is basically over 10% (picture on left).

oth Currency-tied and BTC loans. BTCJAM is telling me that my return is basically over 10% (picture on left).

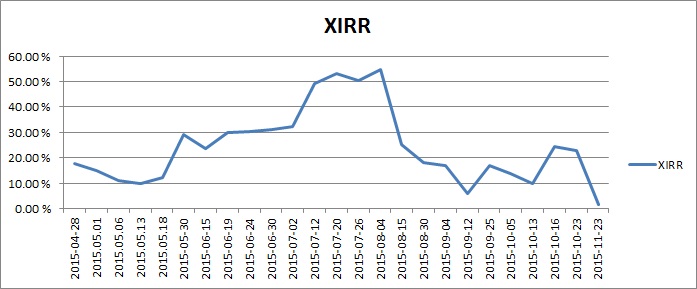

I am doing my own calculation, I was happy. All was quite ok or normal. Before today. Today I got drop of my risk adjusted return from +22% (last month) to just +1.6%!

That was shock!

My first idea was about new big Overdue loans. I know that Joe Maristela, Gennaview are big borrowers and they are late now. But that is still not so big amounts to make so huge drop. After longer look I understood that currency-tied loans made biggest effect on significant drop of my XIRR value.

I have over 50% of my loans currency-tied. With recent rise of BTC price from 220-250-270$ per BTC to 380-350-330$, my borrowers pay back much less BTC and my XIRR measured in BTC went down significantly. I got serious question, if way I measure result and if way I do my investments are correct.

I recalculated return, using USD. I tested what is my current risk adjusted return with different USD price.

| $ | XIRR | |

| BTCPrice | 320 | 38.2 % |

| 270 | 20.7 % | |

| 350 | 48.5 % |

That are numbers that I like much more than 1.6% (return based on BTC).

Clear with difference, but what is correct way to invest?

Some of us will tell – “we leave in normal currency world and it is right to calculate return in our home currency”. Another opinion – we do investments at BTC based Platform, so, right way is to calculate return in BTC. “Price of BTC will grow long run”, they add.

Will it help if Platform will give us 2 ‘virtual’ accounts, allowing us to allocate part of money to tied loans and strict part of money to invest in BTC tied loans? Such virtual accounts protect us from mixing dollars with btc. But, do we need then separate account for USD, RUR, BRL, etc?

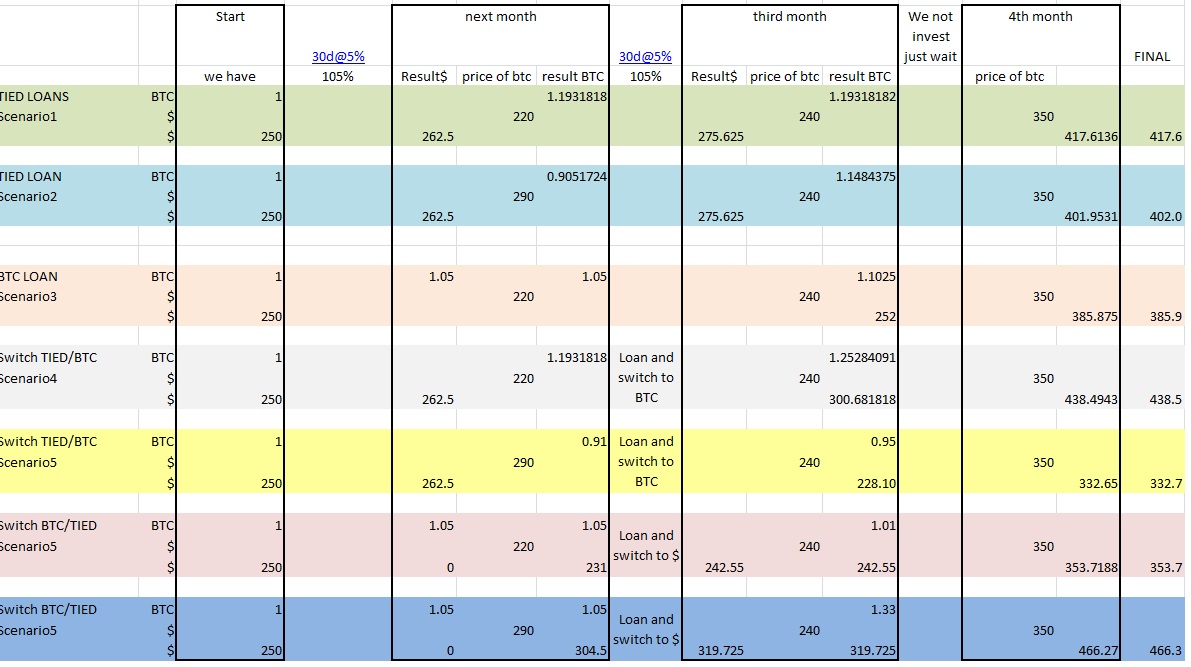

I worry about a lot of “mixed” loans, when I invest at first in BTC loan later at some point in USD-tied loan or vise-versa. I worry that such loans may give at the end very bad return. I did such excel

It simulates few scenarios. We invest twice @5% month. Then we wait one month and calculate result using estimated BTC price.

Scenario 1 and Scenario 2 demonstrates investment in TIED loan when price of BTC goes down-up-up (from initial 270$ per BTC to 220$, then 240$ and finally 350$ per BTC) or up-down-up.

Scenario 3 – pure investment only in BTC tied loan.

Scenario 4-6 when I invest first in TIED loan and then switch to invest in BTC tied loan or first investing in BTC tied loan and later in USD tied.

As we can see, Final return may be very different and difference may be bigger than 10%. Switch in investment strategy may be very positive and as well very negative.

So. Question to you, dear Investors: how to calculate return right way and what is the best investment strategy?

p.s. There you can download excel for BTC-TIED play. I and all new readers of this blog will be very glad if you will share your founding!

Hey Andrej, great post! I invested a sizable part of my assets on bitcoin p2p lending marketplaces and my favorite platform is BTCjam. My strategy for loans tied to currencies is to pick the currencies I’m comfortable in. In my case, as a Brazilian, I pick BRL but also USD and pure BTC loans.

Regarding the account value part of your post, I’m a bit confused with the 150% you use on your formula. Why’s that? My understanding from talking to BTCjam’s team is that on my return info they already consider that loans with late payments will become defaults, meaning we don’t need to add any condition to it.

Keep the good work!

PedroC

https://btcjam.com/users/19544

Hi Pedro!

Thank you for your comments.

I use { x 150%} because part of “current” green loans will become overdue. So, I use current value of Overdue and make it a bit bigger. My experience is telling, that biggest risk of overdue is on first payment. But even when 1-2 payments are done, risk still exist.

If you look Payments page and look on values of Late, then there are calculated only missed payments. If Borrower have loan for 12 month and he missed to pay first installment, then JAM will show value of this ‘missed’ installment as Late (not whole loan). Therefore, if you use values of “Late” form the Payments page, I recommend to multiply that by 2.5-2.7 times. My practice show, that then value of overdue becoming close to real.

Best regards,

Andrej

Most sense would make to track it in your local currency, since that’s what you’ll be exchanging it into in the end I assume? Or if you use BTC for your expenses, then feel free to calculate according to that 🙂

Otherwise BTC is same as any other currency and the fluctuations in the rate affect your return the same way as loan performance.

In theory you could balance the currency risk through some hedging strategy (i.e. buying the opposite currency with leverage through forex) if the amounts are big enough or simply investing same amounts in opposing currency where possible etc.

Or you could try to assume which currencies are good investments since you would have to also account for possible currency fluctuations in addition to loan performance.