Hello!

I have been traveling and decided to change format of report to make tracking of performance more visible. Therefore I am a bit late with my overview. But it is ready now.

I removed part of columns in comparison. Each month I will compare value of risk adjusted return(XIRR). This value eliminates periods when money are on platform, but not invested (stay “without work”). No work – no return to investor. This is counted. Also this value reduce value of defaulted or overdue loans. Because if I like to exit, I will not be able to sell overdue loan for 100% of it’s value. Unfortunately many platforms do not count in such way and gives to investor much too optimistic numbers.

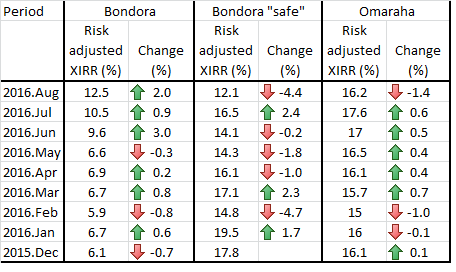

Investments in Euro (fiat currencies)

Comments:

Comments:

Bondora. Bondora is telling that return on my “safe” portfolio (that contain ~95% Estonian loans) is over 30%, but my calculation say it is ~12% only and going down. I got a lot of overdue loans from my last investments on primary market. If it will go so, then probably most of passive investors will get 8-14% return in long run. My “active” portfolio performed a bit better, mainly due to activities on SM. My strategy – buy/sell on secondary market, no new investment and I still doing withdraw.

Omaraha. Surprised me a bit this month with bigger number of overdue loans. Hope numbers will restore in September. Still I work less than 5 min week to look over my investments there. Just for interest, Omaraha is telling my return is ~25%.

I almost closed my account on Twino. I would say you cannot anymore trust in fast sale of your investments at TWINO. I put all my loans on sale in April and some loans are still not sold.

Investments in BTC and crypto currencies

BTCPOP. I am getting a bit more trust in BTCPOP. It is at the moment best place for me to get personal BTC tied loan. I do not invest at POP so much like on JAM, but last month I asked special loan to invest at POP only. Platform is telling that my expected ROI is ~13%, current about -6%. I am getting much worst number, but feel that situation changed into the positive side.

Loanbase. I still have over 80% in not-performing loans. Two big loans to “trusted guys” made my return dramatically bad. That is story about big risk in BTC world and limited trust even in old borrowers. I hope that guys will repay, but this will not compensate potential profit from reinvestment. Still very sad, that so nice and rich in functionality platform cannot find more borrowers and provide more opportunities to invest.

BTCJAM. Surprised me in very positive way. I need to analize, why this month my return in BTC grow so fast. It may be so, that I invested during last month much more into BTC tied loans. Currently I am doing mostly small bids. Many of trusted borrowers from US cannot use JAM and I am trying to form new base of trusted borrowers. This month I will try to look how many loans went to default per different month. This will help me to see better if new JAM borrowers are safe or not. Just for interest, JAM is telling my return is ~10% on main portfolio and 14% on “safe” portfolio. I am getting a bit better numbers

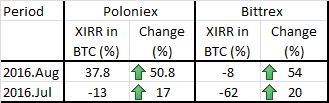

Trading

Since April -May I tried more active trading. I trade altcoins on Poloniex and Bittrex. Thanks to Bifinex, that they had issues with creation of account for me. I was ready to send some btc to Bitfinex exchange just 2 days before they collapsed. I do not trade BTC/USD pair.

I do not invest in trading too much of my funds. Fist 2 month I got big losses because of DAO and ETH. It took me about two month to recover it. Big thanks to ETC, XCP and WAVES.

There are my current results.

I am still very unexperienced and need to learn a lot, but overall, altcoin trading looks interesting.

Consolidated return from crypto projects

I discount BTC value by 5% when I count XIRR. I am still recovering from some scam and bad decision done in past. My activities become more concentrated. Let’s see, how my results will look at the end of Summer.

I discount BTC value by 5% when I count XIRR. I am still recovering from some scam and bad decision done in past. My activities become more concentrated. Let’s see, how my results will look at the end of Summer.

I wish you all good investments and vacations this summer!

p.s. Finished projects

FellowFinance – Return about 12% (March 2016)

Twino- return 13.8% (July 2016)

NXT assest – negative return (May 2016)

Still to check: Finbee, Savy, Viventor, Mintos, Bitbond.