Time to time I hear question where to invest. Once I told that this recommendation depends on several criteria. Let me explain what I had in minds.

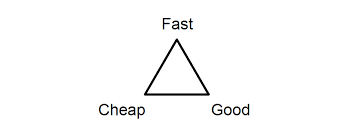

In classical triangle “fast-cheap-good” you can select only two of three values. i.e. fast and cheap, but then result may become not so good. When I am getting question “where to invest” I propose you to think about the following 3 components

- Time

- Money

- Planned return.

That factors does not work in same way as “fast-cheap-good” triangle, but are very related.

To some extend I threat Profit as a function of Invested money and Spent time. In simple words, to get bigger profit you need more time or/and money, to get less profit you do not need so much time. Sorry for so trivial start of an explanation, but may be you will continue reading.

Time

Time you dedicate to work with your portfolio can give you bigger profit. Sure, there are some bad exceptions, but I hope it is not about you and me 🙂

Time is needed to get knowledge/experience about

– who is trusted borrower,

– which loan to invest,

– what to do after you invested (sell or hold, what discount/premium, when to sell),

– what is return, and

– which platform gives me best return .

Time is needed to learn about new platforms, understand risk of platform, invest in different loans to get at least some diversification. Time is needed to accumulate results from one or few platforms for calculation of return and later for calculation of taxes.

And if you like to achieve better than average Profit, then it becomes a bit more complicated. Do you have time and knowledge to analyze loan datasets, analyze customer profile, track history and build some investment models, do you have time to parse website to collect data from it, do you have time and possibility to create automated programs (bots).

Based on your time and knowledge I would suggest:

- If you have just few hours per week and no possibility to spend hours and days with excel and programming of scrypts, then simply use platforms with good Autoinvest possibility.

- If you are programmer, statistician or/and have at least several hours per day to work on your investments , then most probably I will say “forget about Autoinvest function”, and most probably I will suggest to look for platform with good data export possibilities, possibility to parse website, API for getting portfolio, loan and doing investments.

Money

Two aspects you need to consider:

1. Liquidity. Can you invest for several years or you would like to have part of money available at any time.

If you need part of money available at any time, then platform must have Secondary market or you need to invest only into short term loans. Such loans must be available on platform.

2. Investment amount. Amount like several hundreds Euro per month is possible to ’employ’ fast on almost every normal platform. But if you plan to invest something like 10.000€ or bigger amount, then you need to think about usage of several platforms and, maybe, platforms with a possibility to buy loans on secondary market.

Amount of invested capital is a important factor when you think about diversification of your investments. If you invest smaller amount, then 2-3 platforms will be fine. Too big number of platforms will require a lot of time to manage and monitor investments, and that will make no sense. If you invest over 20-50 thousands I will definitely suggest to use more than 3 platforms.

I think, we are coming to that moment, when number of p2p platforms is becoming big and some of them will probably be sold or die. Venture capital will ask for result, will ask about growth. Not every platform will be able to grow and find customers. Not every platform will manage human resource growth, cross-border growth and technological side. And probably some platform could be born by smart guys as ‘experiment” to do fast great profit. To avoid big loses it is much more safe to spread money between several platforms.

When you think about diversification, I will recommend to think about alternative platforms too. It can make sense to invest small part of your capital into crypto currency based platforms or opposite into more safe investment instruments.

Profit

Ok, profit 🙂

Some investors are happy to get 6-8% yearly return after bad debts. I would say they should look for 2-3 platforms with an effective auto-investment possibility. I don’t think it is rational to spend a lot of time if there is such appetite for profit. Most important is to lower risk of platform.

Investors who like to achieve 12-16% return need to accept a bit bigger risk or invest a bit more into monitoring of platforms and return on it. Still there are platforms that claim their Autoinvest plans providing return in that level. Most probably Investor will need to understand how Secondary market is working and sell some less profitable or more risky loans or buy some good loans using simple filtering.

If I forget miracles (and you are not professional programming statistician), I sill say that there is no real possibility to get stable return over 18% (and especially over 22% return) if you do not have several hours per day to monitor, analyze, automate your investments. When I say “several hours” I mean at least 2-4 hours per day, but to be realistic 5-14 hour per day. I think you will need to diversify portfolio via several platforms and most probably will use alternative platforms, too. Some platforms will provide you 12-16% ROI, some will require bigger attention and will bring bigger risk, but will give ROI over 25%.

In next post I will try to put some platforms into simple table and will try to share my opinion how platforms sweets for different types of investor.

P.S. Whatever you will decide. do not forget to monitor periodically and review result of your investments. Platforms are changing rules, platforms are lowering interest. Do not be surprised that you are getting zero or negative result instead of a planned profit.

P.P.S. Read more and get some ideas about investment platforms and strategies – an old but still interesting good article “16 tactics and strategies for P2P-lending” from RahaFoorum.

Thank you for your reading and thank you in advance for votes and comments!

I think, we are coming to that moment, when number of p2p platforms is becoming big and some of them will probably be sold or die. ==> I think that first candidate is bondora or ???

I hope defenitely not Bondora. They are too big to be the first. A lot of money already invested. Venture capital will find ways to manage management/strategy/communication crisis (imho)

Also, do not forget, that many Bondora is “making” market. Many new platforms see what Bondora is doing and trying not copy mistakes. But also, that new platforms will need to answer huge challenges, when active Bondora users will come and will start to ask a lot of questions about their functionality. Not all new will be so good like they looks now 🙂

well written, keep it coming 🙂

Very informative article