February I will celebrate 3y since my first investments at p2p platform. 3 years ago I did first deposit to Bondora (former Isepankur). And March I will pass 12 month since my first investments at BTC based p2p lending platform (BTCJAM).

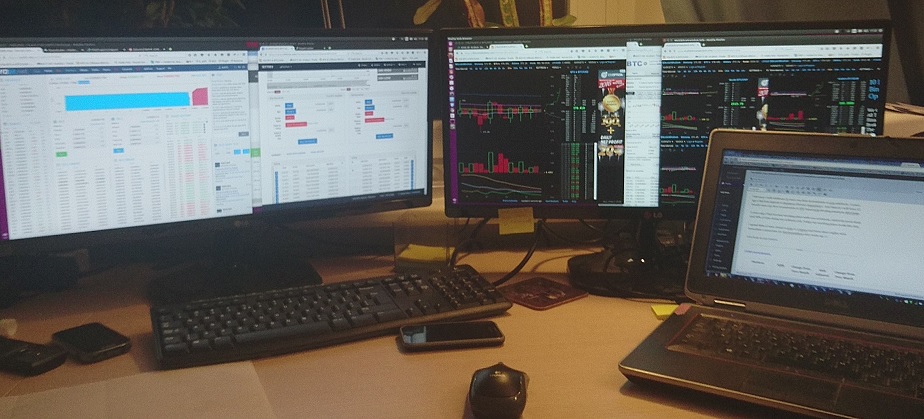

3 years ago I had normal standard working place with notebook, relatively good sleep and 90% of time doing my ordinary job. Today my working place looks like this,

and I use 2 ultra-wide monitors, I spend 80% of time closed to p2p or cryptos and have short nights with immediate connection for bitcoinwisdom after wake-up 🙂

and I use 2 ultra-wide monitors, I spend 80% of time closed to p2p or cryptos and have short nights with immediate connection for bitcoinwisdom after wake-up 🙂

Lets look on my return and understand, is there any reason in life like mine 🙂

EURO investments

| Platform | XIRR | Change from Prev Month | Risk Adjusted XIRR | Change from Prev Month |

| Bondora | 23.3 % | +0.6 % | 5.9 % | -0.8 % |

| in that, Bondora “Safe Portfolio” | 27,6 % | -0.1% | 14.8 % | -4.7% |

| Omaraha | 18.6 % | 0% | 15,0 % | -1 % |

| FellowFinance | 72.3% | +53.8% | 32.7 % | +23.8% |

| TWINO | new platform | — | — | — |

* XIRR – Return of investments calculated by me, not by platform. Deposited, but not invested money makes negative impact to XIRR

** Risk Adjusted XIRR – XIRR after write off part of overdue and defaulted loan

COMMENTS on Euro based investments

Bondora. After longer investigations I will lower my portfolio at Bondora again. I plan to leave at Bondora about 5-10% of my initial investments. I have almost finished special post that explains reasons behind of my decision.

Omaraha. My return have decreased a bit. I think it is driven by the following two reasons:

- In January I increased again a bit (by 25%) my my portfolio and not all money are still employed;

- I had relatively big increase of portfolio in December and that lead to almost double of overdue loans.

I do not plan to add more money to Omaraha (mainly because lack of Secondary Market), and will wait next month, to see what will be status of overdue payments. Till now I am fine with return from Omaraha, having in mind that I don’t spend more than 10 minutes week to look over my portfolio.

FellowFinance. I wish to have 25-35% return from this platform and my real return is coming closer to my expectations. FellowFinance have announced an expansion to of Swedish and Polish market, but I do not see any new loans from that countries. I don’t plan to add new deposit to this platform at this moment. My observations – platform is still a bit slow and interest of best loans decreased. As example,few month ago 4 stars rated loan had 28% interest, now such loan is coming with 19% or lower interest. From other side FellowFinance have good secondary market and I will be very really happy if my return will stay like it is today.

Twino. I was looking for an alternative of Bondora with possibility of fast exit. I got recommendation to test Twino.eu. After I did deposit and created my autoinvestment plan, my money where employed in less than 5 minutes. I was impressed by amount of loans (over 2000 loans) and I like bayback guarantee. I plan to get over 12% return and I am adding more money into Twino platform. I had several questions and all of them were answered in less than minute via Skype support. Nice! 🙂

Investments in crypro currencies and projects

My return:

| Platform | XIRR | Risk Adjusted XIRR | Change from Prev Month | XIRR in Euro |

| BTCPOP | 28.4% | -30.6 % | +26.5% | |

| Loanbase | -8.7 % | -8.7 % | + 26.1% | |

| BTCJAM | -3.3 % | +15.9 % | +29.8 %(+10.2%) | |

| “Safe portfolio” at BTCJAM | +27.1% | +11.2% | +47.8%(+17.8%) | |

| Secureae(NXT) | +27.1 % | -2.9% | -75 % (-11% from last month) | |

| SCRT coins | +192 % | 22.5 % | +32% |

*** XIRR in Euro – XIRR when deposits counted in Euro and price of BTC_today =[CurrentBTCPrice+ AveragePriceWhatIBoughtBTC]/2

| Risk Adjusted XIRR in BTC | Risk Adjusted XIRR in Euro |

Used BTC Price | ||

| TOTAL INVESTMENTS into crypto projects | -31.2 %(+9.2%)

|

+14.7% | 377$*0.95 (5% discount) | |

COMMENTS

There was nothing very special during January. I continue to restore from bad loans at BTCPOP and Loanbase. I plan overview of my investment portfolio at BTCJAM. March 14th will be exactly one year since my first investment there.

Secureae announced end of life, and now I am using mynxt.info. Not so flexible, but possible to do main buy/sell/monitor my NXT assets.

I had thinking to start investments at Bitbond. I like how site is working. I like presentation of interesting information about p2p lending at Bitbond site. I postponed a bit start of my investments there until better price of BTC. As well I need to investigate more a possible return at Bitbond, since APR of their loans is lover compare with BTCJAM/Loanbase and rate of defaults is quite high.

Ah. Ok, one may be important thing – I have decided that return in Euro is main indicator to take care, even I invest in crypto currencies.

Thank you for your reading! I will be very glad for your feedbacks and evaluations. That is something, what helps and motivate me to write more interesting and often 🙂

Have you tried Mintos? Any comments?

Thank you for question. I have not tried, but I was looking over Mintos since their start. I got similar question on Facebook, and share my reply.

“Please understand, that I need more time to recommend or not recommend TWINO. But, what I see today

1) ROI is not worst than Mintos

2) Full bayback guarantee

3) Huge number (over 2000) of loans

4) They claim very fast secondary market. I was looking for platform for short term investment

5) Huge number of 1 month loans – I can exit fast

6) Fast working, simple platform

7) and may be most important – recommendation of several well known users

8) No time needed to review loans etc. Simply deposit, set autoinvest and forget.

I will look other platform if I like to get return bigger than 15%. AGAIN: I just started, I cannot recommend I only share what I see today”.

do you know anything about the pool investments on btcpop

Yes. I use Pool (Trusted and A rated) investments at pop. Even increased my participation in pool last month. My opinion it is good especialy for newcomers who decided invest at btcpop

I cant find info, but how do you calculate XIRR Change from Prev Month Risk Adjusted XIRR.

I do it manually. Simply if last month XIRR was 10 and this month 11, then change is +1. May be not best way as some mistakes may come, but I han’t found any better solution